OKLAHOMA CITY, Jan. 21, 2016 /PRNewswire/ — Ascent Resources – Utica, LLC (formerly known as American Energy – Utica, LLC) (“ARU”) and ARU Finance Corporation (formerly known as AEU Finance Corporation) (“Finco” and together with ARU, the “Issuers”), subsidiaries of Ascent Resources, LLC (formerly known as American Energy Appalachia Holdings, LLC), announced today the commencement of a private offer to exchange (the “Exchange Offer”), upon the terms and subject to the conditions set forth in the information memorandum, dated January 21, 2016 (the “Information Memorandum”), the related letter of transmittal and the related beneficial owner information form, any and all of the outstanding 3.50% Convertible Subordinated Notes due 2021 (the “Existing Convertible Notes”) held by Eligible Holders (as defined below), for newly issued 3.50% Convertible Subordinated Notes due 2021 (the “New Convertible Notes”) and incremental junior secured loans due 2019 (the “New Junior Secured Loans”).

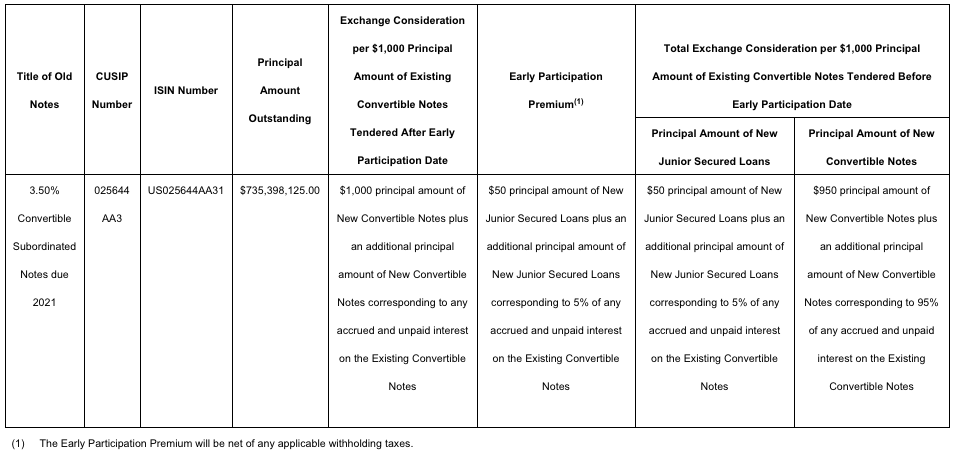

The Exchange Offer will expire at 11:59 p.m., New York City time on February 18, 2016, unless extended by the Issuers (such date and time, as they may be extended, the “Expiration Date”). In exchange for each $1,000 principal amount of the Existing Convertible Notes that is validly tendered and not validly withdrawn, plus the accrued and unpaid interest thereon, which the Issuers have elected to pay in kind, at or prior to 5:00 p.m., New York City time, on February 3, 2016, unless extended by the Issuers (the “Early Participation Date”), the Eligible Holder will receive total exchange consideration consisting of (i) $50 principal amount of the New Junior Secured Loans plus an additional principal amount of New Junior Secured Loans corresponding to 5% of any accrued and unpaid interest on the Existing Convertible Notes and (ii) $950 principal amount of the New Convertible Notes plus an additional principal amount of New Convertible Notes corresponding to 95% of any accrued and unpaid interest on the Existing Convertible Notes (the “Total Exchange Consideration”). In exchange for each $1,000 aggregate principal amount of the Existing Convertible Notes that is validly tendered and not validly withdrawn, plus any accrued and unpaid interest thereon, which the Issuers have elected to pay in kind, after the Early Participation Date but prior to Expiration Date, the Eligible Holder will receive exchange consideration consisting of (i) $1,000 principal amount of the New Convertible Notes and (ii) an additional principal amount of New Convertible Notes corresponding to any accrued and unpaid interest on the Existing Convertible Notes. Tenders may be validly withdrawn at any time on or prior to 5:00 p.m., New York City time, on February 3, 2016, but not thereafter unless required by law. The Issuers plan to incur the New Junior Secured Loans and issue the New Convertible Notes on or about the third business day following the Expiration Date (the “Settlement Date”). The New Convertible Notes are not and will not be listed on any securities exchange.

The following table sets forth the exchange consideration, early participation premium, and Total Exchange Consideration for the Existing Convertible Notes:

CLICK TO VIEW LARGER

In addition to New Junior Secured Loans, each holder whose Existing Convertible Notes are accepted for exchange will receive a cash payment in lieu of any fractional portion of the New Convertible Notes below the minimum authorized denomination.

The consummation of the Exchange Offer is subject to, and conditional upon, the satisfaction or waiver of certain conditions, including, among other things: (i) the valid tender (without valid withdrawal) of at least 90% in aggregate principal amount of the Existing Convertible Notes, (ii) accession of all participating holders to ARU’s existing junior secured term credit agreement, (iii) entry by all participating holders into a subscription agreement with respect to the New Convertible Notes (the effectiveness of which is in turn subject to, and conditioned on, a $212.0 million equity contribution to Ascent, of which $177.0 million is to be contributed to ARU), and (iv) entry by all participating holders into a registration rights agreement with the Issuers. The Issuers are actively working to meet these conditions and based on discussions they have had with certain holders of the Existing Convertible Notes, and subject to completion of final documentation and the absence of further material adverse developments, the Issuers expect that at least 70% of the total outstanding Existing Convertible Notes will be tendered into the Exchange Offer.

The Exchange Offer is only made and documents relating to the Exchange Offer will only be distributed to “Eligible Holders” of Existing Convertible Notes who complete and return an eligibility form confirming that they are either (1) a “qualified institutional buyer” as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), or (2) a person who is not a “U.S. person” as defined under Regulation S under the Securities Act. The complete terms and conditions of the Exchange Offer, as well as the terms of the New Convertible Notes, are described in the Information Memorandum, the related letter of transmittal and the related beneficial owner information form, copies of which may be obtained by contacting Global Bondholder Services Corporation, the exchange agent and information agent in connection with the Exchange Offer, at (866) 924-2200 or (212) 430-3774 (banks and brokers) or by visiting http://gbsc-usa.com/eligibility/Ascent_Resources to complete the eligibility process.

The New Convertible Notes have not been and will not be registered under the Securities Act or under any state securities laws. The New Convertible Notes may not be offered or sold within the United States or to or for the account or benefit of any U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act.

About Ascent Resources – Utica, LLC:

Ascent Resources – Utica, LLC is an independent natural gas and oil company affiliated with Ascent Resources, LLC that is focused on the acquisition, development and production of unconventional natural gas, natural gas liquids and oil resources in the Utica Shale play in eastern Ohio.

About Ascent Resources, LLC:

Ascent Resources, LLC was created in December 2014 through the combination of Ascent Resources Utica Holdings, LLC (formerly known as American Energy Ohio Holdings, LLC) and Ascent Resources Marcellus Holdings, LLC (formerly known as American Energy Marcellus Holdings), which respectively own Ascent Resources – Utica, LLC and Ascent Resources – Marcellus, LLC (formerly known as American Energy – Marcellus, LLC). Since its inception, Ascent Resources, LLC has established a leading position in the Appalachian Basin, with approximately 280,000 net acres purchased or under contract.

Ascent Resources, LLC and Ascent Resources – Utica, LLC Media Contact: Ms. Anne Pearson, Dennard Lascar Associates, LLC, 210-408-6321, ascent@dennardlascar.com